how much does illinois tax on paychecks

The income tax system in Illinois emphasizes simplicity. Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Illinois paycheck.

Bigger Paychecks In 2022 With Expanded Tax Bracket Ranges And A Larger Standard Deduction Aving To Invest

Illinois employers may establish.

. Although you might be tempted to take an employees earnings and multiply by 495 to come to a. The first step to calculating payroll in Illinois is applying the state tax rate to each employees earnings. Currently the Illinois income tax is a flat rate tax.

No Illinois cities charge a local income tax on top of the state income tax though. Helpful Paycheck Calculator Info. Although you might be tempted to take an employees earnings and.

Personal income tax in Illinois is a flat 495 for 20221. Illinois Taxes Explained in Detail Illinois has a flat income tax of 495 percent which is the lowest in. The Illinois income tax was lowered from 5 to 375 in 2015.

Illinois Hourly Paycheck Calculator. You exceed 12000 in withholding during a quarter it is your responsibility to begin to pay your Illinois withholding income tax semi-weekly in the following quarter the remainder of the year. The state UI tax rate for new employers also known as the standard beginning tax rate also can change from.

According to the Illinois Department of Revenue all incomes are created equal. Illinois has a flat income tax of 495 which means everyones income in Illinois is taxed at the same rate by the state. The first step to calculating payroll in Illinois is applying the state tax rate to each employees earnings.

Illinois Paychecks federal national and state compliance resources - regulations laws and state-specific analysis for employers and HR professionals. The first step to calculating payroll in Illinois is applying the state tax rate to each employees earnings. As of 2018 the state income tax rate for Illinois is 495 percent of income.

Employers are responsible for deducting a flat income tax rate of 495 for all employees. Payroll benefits and everything else. Previously the tax rate was raised from 3 to 5 in early 2011 as part of a statewide plan to reduce deficits.

IL-941 Illinois Withholding Income Tax Return Quarterly due either the last day of the month following. Everyones income in Illinois is taxes at the same rate due to the states flat income tax system of 495. Generally the rate for withholding Illinois Income Tax is 495 percent.

Generally the rate for withholding Illinois Income Tax is 495 percent. Automatic deductions and filings direct deposits W-2s and 1099s. Also not city or county levies a local income tax.

As of 2018 the state income tax rate for Illinois is 495 percent of income after deducting for allowances the employee claims on IL-W-4. During the course of employment no cash advance repayment agreement can provide a repayment schedule of more than 15 of an employees wages per paycheck. If you expect to owe.

Forms required to be filed for Illinois payroll are. The states flat rate of 495 means that you dont need any tables to figure out what rate you will be paying. For wages and other compensation subtract any exemptions from the wages paid and multiply the result by 495 percent.

Gusto offers fully integrated online HR services. Why Illinois Is In Trouble 109881 Public Employees With 100000 Paychecks Cost Taxpayers 14B. How much is payroll tax in Illinois.

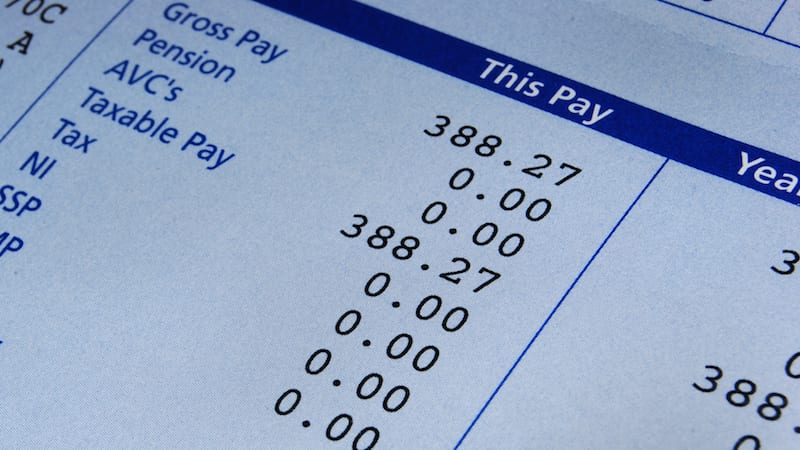

The Illinois Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Illinois State Income. Up to 25 cash back In recent years it has been slightly less than 13000. Why Gusto Payroll and more Payroll.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4. Both employers and employees are responsible for payroll taxes. Personal Income Tax in Illinois.

Employers can find the exact amount. Federal tax rates like income tax Social Security 62 each for both employer and employee and Medicare.

New W 4 Irs Tax Form How It Affects You Mybanktracker

Illinois Paycheck Calculator Smartasset

How Many Tax Allowances Should I Claim Community Tax

Paycheck Calculator Take Home Pay Calculator

Illinois Paycheck Calculator Smartasset

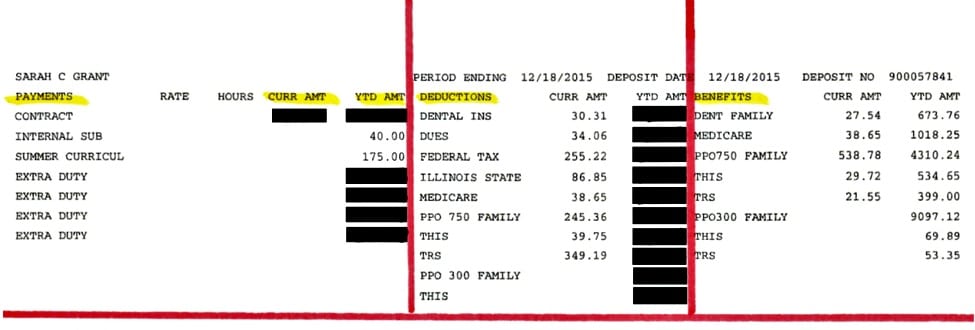

Understanding Your Teacher Paycheck We Are Teachers

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Understanding Your Pay Statement Office Of Human Resources

Understanding Your Teacher Paycheck We Are Teachers

2022 Federal State Payroll Tax Rates For Employers

Taxes 5 1 Taxes And Your Paycheck Payroll Taxes Based On Earnings Paid To Government By You And Employer Income Taxes You Pay On Income You Receive Ppt Download

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

W 4 Form How To Fill It Out In 2022

Here S How Much Money You Take Home From A 75 000 Salary

Paycheck Tax Withholding Calculator For W 4 Tax Planning

New Tax Law Take Home Pay Calculator For 75 000 Salary

:max_bytes(150000):strip_icc()/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)